|

6/25/2024 0 Comments New construction around us.According to Culture Map, "Dallas sold the second-highest number of new construction homes nationwide in March 2024, looking at 'Where the Most New Construction Homes Are Being Added – 2024 Study.' The metro area claimed the No. 2 spot out of 153 U.S. cities ranked based on Zillow's real estate data from March and April."

New Construction Report Numbers

0 Comments

6/19/2024 0 Comments Mortgage Rates?The FED has lowered rates. Even with some inflationary numbers staying the same, they are seeing the boost that home sales need right now. It is likely that this rate (or something close) will hold for a little while, so now is a time to look for some who have been waiting.

Mortgage Rate News Here. 6/17/2024 0 Comments June Check InWhat may have held back buyers the past year? Probably:

High Mortgage Rates. The news is that these are coming down! This week we've dropped below 7% again. As buyers look at this right time to return to the market, sellers are responding and listings are increasing week by week. Latest Listings? --> Check it Out Here. You may be hearing that there's a spike in inventory, and it's true. But that was needed. As more homes come on the market, it drives prices down/competitive. We are showing a 3-6 month supply of homes are on the market, and this is healthy now. We are in the "Sweet spot" of it being a good time to be buying OR selling, especially if one can find the mortgage rate they want. National Info Here D-FW Info Here 5/21/2024 0 Comments Summer's coming!It's May! It's time to be ready for the North Texas Summer months. A more extensive list is attached, but here are general and quick tips/tricks:

1. Pay attention to doors and windows, and how they seal up. Check your caulking and look for areas that got wet over spring. 2. Rinse out your gutters and other areas of your roof. Everything will now bake in the summer sun, so it's helpful to clean out grime and get any accumulation out. This will help on our windy or rainy days to come. 3. Do a walk around of your wood and stone areas. It's just a good time to notice how critters have effected your place, and what wear and tear the winter/spring has brought. You might want to patch something up or have work done so you can enjoy your outdoor spaces all summer. 5/13/2024 0 Comments Market Look for NowFriends, our local market is picking up. We are seeing multiple offers on homes for sale and sellers getting prices they prefer in faster and faster windows. One thing this means is that if you are waiting to buy, now really is the time. This summer will probably pick up even more, as the season moves into the prime moving time of the year.

So let's look now! Also, we continue to see rising prices/values in our neighborhoods. I talk with buyers about their budgets, and for those who have set a price and are waiting for a dip ... it still isn't happening in our areas. Instead, values continue to rise. And that looks to be the case with the stability of the metroplex, job market, and the steady rise of prices from the past few years through this year. So, for instance, a home that needs no work and no updates-- in zip codes like Coppell, or Grapevine, or Flower Mound -- it is difficult to budget something like 450k and find exactly what you're looking for. The values have risen and are rising out of this price range. Now may be the time to "get in" to something so that you can see the value rise as you own it. And then make your upgrades in time to come. This pertains to interest rates too. They are higher than recent years, but the value you can get by getting a home at current prices probably outweighs the hassle it will be to re-finance when rates go down. They will. And it seems a better bet that rates go down over the bet that values/prices go down. That's where we are! Don't get priced out of the market by waiting too long! Let's help you make a move. 5/6/2024 0 Comments Mortgage Rates in MayAs for Mortgage Rates, everything is in a hold right now. Everything is paused, waiting on the Federal Reserve and seeing what they might do. "The central bank raised rates 11 times in 2022 and 2023, with the expectation that it would reverse course this year. But as inflation has trended up, the central bank is standing pat. Following the Fed’s May 1 meeting, its third gathering of the year, Chairman Jerome Powell held steady again, announcing no change in interest rates for the time being." www.bankrate.com/real-estate/how-fed-interest-rate-affects-housing-market/

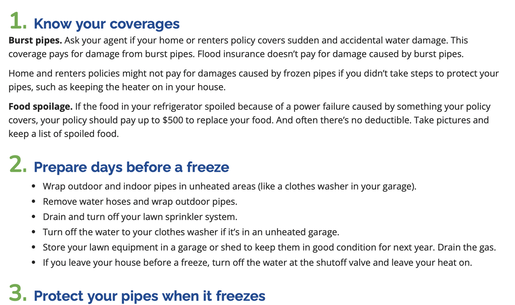

Here's the link to more info, as of May 1. Our thoughts?: It will change, but move forward now so you get the home/price/value you want. Here's a great/informative file for you or to share to someone: TIPS! how-to-increasing-your-homes-value-1706287091.pdf 1/19/2024 0 Comments Winter Weather ReadyFriends and neighbors of North Texas, we’re past the latest freeze but it doesn’t mean more isn’t coming. So there’s still good reason to secure your home and be weather-ready. Here are two helps: 1. Texas Department of Insurance talks about weather proofing and preparation: 2. And, Super local to yours truly is the city of Coppell. The city’s “Winter Weather” page is good and it's here: www.coppelltx.gov/673/Winter-Weather Let’s be smart and safe. Our community can thrive together! And the O'Reilly Home Team is always here for you! 1/8/2024 0 Comments Where We Stand, 2024Here's where the national market seems to stand, and an outlook for D-FW. Most experts anticipate this year being good/stable for buying and selling homes.

Anticipations: Mortgage rates might decrease. *We know this, because of the rise in 2023. The FED will want to keep people at rates that they can roll with. So, a decrease, but not dramatic -- that's the expectation. Meaning: You can buy now and refinance later if they really do drop. But, don't skip out on a good deal because the rates will eventually change, and it's important to get the home price you want/need now! Homes will go on the Market for Sale -- Again, a reaction to 2023 anticipates that folks will "loosen" the grip they've had (holding onto homes) and jobs and life changes will lead to more inventory. Still, we expect a slow change here, meaning: Do what you need to, when you need to. There probably won't be some flood of homes to choose from. With rate changes and more homes on the market, we anticipate More Buyers in 2024 -- People waited in 2023, but the need and desire is there. The market is bubbling with moves, and so we see folks taking the leap in this year. The challenge for buyers is also the reason that it is good to make a smart move if you can, and that reason is: Home prices are stable, and our area is strong. While the first three points are all national trends, what we can anticipate for all the D-FW job and economy growth is that our home values are stable and growing. There won't be huge price drops this year. And while that makes paying large amounts for homes difficult, the track record shows these investments are worth it over time. Since the pandemic, D-FW has been a leader in economy and job growth, and so the livability and desire for our area remains as strong as ever. Your home investments are good real estate investments! We have a hopeful year ahead! So, let's make a move! References: https://www.brightmls.com/article/2024-national-housing-market-outlook https://www.recenter.tamu.edu/articles/video/Texas-Housing-Market 12/15/2023 0 Comments Creative Lending Options to Buy Now!As we approach the end of the year, and people keep dreaming of a new home, or maybe even becoming first-time homeowners, we want to share resources with you for the dreaming!  There are lenders trying all they can do to encourage people into home-ownership, and maybe what they offer works for you or someone you know!

- Grants while applying - First time home buying “cash back” scenarios - Lenders covering down payment options - Financial Supports and flexible options. So, check in with us and we can get you talking with a qualified Lender. This is a great first step. Maybe the wisdom will be to wait. But, maybe the doors will open to help a home-buyer find the right way into the market here and now. Let’s look together! 2 Notes to Notice:

1. Grapevine's "Paycom" (an Oklahoma City-based firm) will about double in size with coming expansion. Another 1,000 employees anticipated. See that here: Dallas News Paycom 2. In September Texas remained ranked in top 5 states for overall # of new businesses. More than 50,000 new businesses have opened in the Lone Star State in 2023. This means jobs, and people, and folks moving in/out of homes! TX growth report. 10/6/2023 0 Comments Market Note into OctoberMarket Note: in fall and winter, the DFW market is up from late summer numbers.

Interest rates have been high, but researches note home sales up 9.5% for consumers and construction permits up 5.3%. Time for homes on market has gone down as well. It's a good time to look/research/consider a move. Here's the Info from A&M's Texas Housing Insight: INSIGHT. 9/4/2023 0 Comments Mortgage Rates Right Now"Total mortgage application volume fell 2.9% last week, compared with the previous week, according to the Mortgage Bankers Association’s seasonally adjusted index."

See his helpful review of rates and changes by cnbc here: Mortgage Demand Drops 7/28/2023 0 Comments What to Watch ForHere's Dallas News reporting on an example in McKinney with "Craig Ranch" Homes. There are fees from the HOA when homes are sold, and the fees increasing with increasing home prices. Buyers and sellers are reporting feeling blind-sided.

(Reach out and we will research hidden fees in areas you are interested in!) 6/27/2023 0 Comments Welcome to the Team!

5/3/2023 0 Comments Our Market

4/12/2023 0 Comments Did you get one?Each year we've reminded folks of tips to appeal your higher property tax, and we've seen good results. With inflation of common goods, now is not a good time to see your far higher housing value cost you taxes. So, the appeal is fairly simple and lower taxes can help your wallet a lot.

Call me, I'll walk you through it! 214-289-6176 4/5/2023 0 Comments More encouragementWe live in a unique place that is beginning to see the "returns" on what our metroplex industry and liveability means for homeowners.

Dallas News says, "Middle-income Dallas-Fort Worth homeowners made an average $167,560 from their homes over the last 10 years, while the same group on the national level made $122,100, according to a new report from the National Association of Realtors." This is part of why we love working with people and their homes. We hope the fruit of these investments is both living in a place you really love as well as becoming a source of income and value for each of us. For now, it's true in D-FW. The property is worth it. 4/2/2023 0 Comments April News:Our market, like the nationwide reactions, has been in flux. Predictions remain steady, with the idea that buyers are seeing more and more homes on the market. Overall, it's still a good time to buy and sell.

Yes, interest rates have risen. But they are not forecasted to go down soon. Instead, higher rates usually mean home prices go lower, and thus a buyer can get in to something good and get passed renting. The Uplifting D-FW news remains: our area has seen such growth in homes and jobs that the market here will be stable and valuable for investments. Source: Yahoo Finance |

AuthorWrite something about yourself. No need to be fancy, just an overview. Archives

June 2024

Categories |

RSS Feed

RSS Feed